Save 30% With Your HSA/FSA

Use tax-free dollars on HSA & FSA eligible wellness products to keep money in your pocket.

How It Works

Check if you have a work HSA/FSA account

HSA/FSA accounts let you spend without paying income tax. Pay with money already set aside for qualified health spending!

We provide you a Medical Necessity letter

We’ll connect you with a licensed provider who can confirm our formulas qualify for your health needs.

Spend & save

Use your HSA/FSA funds for approved purchases or get reimbursed, often saving around 30%

Instructions

Add products to your cart and make sure to click “Try Once"

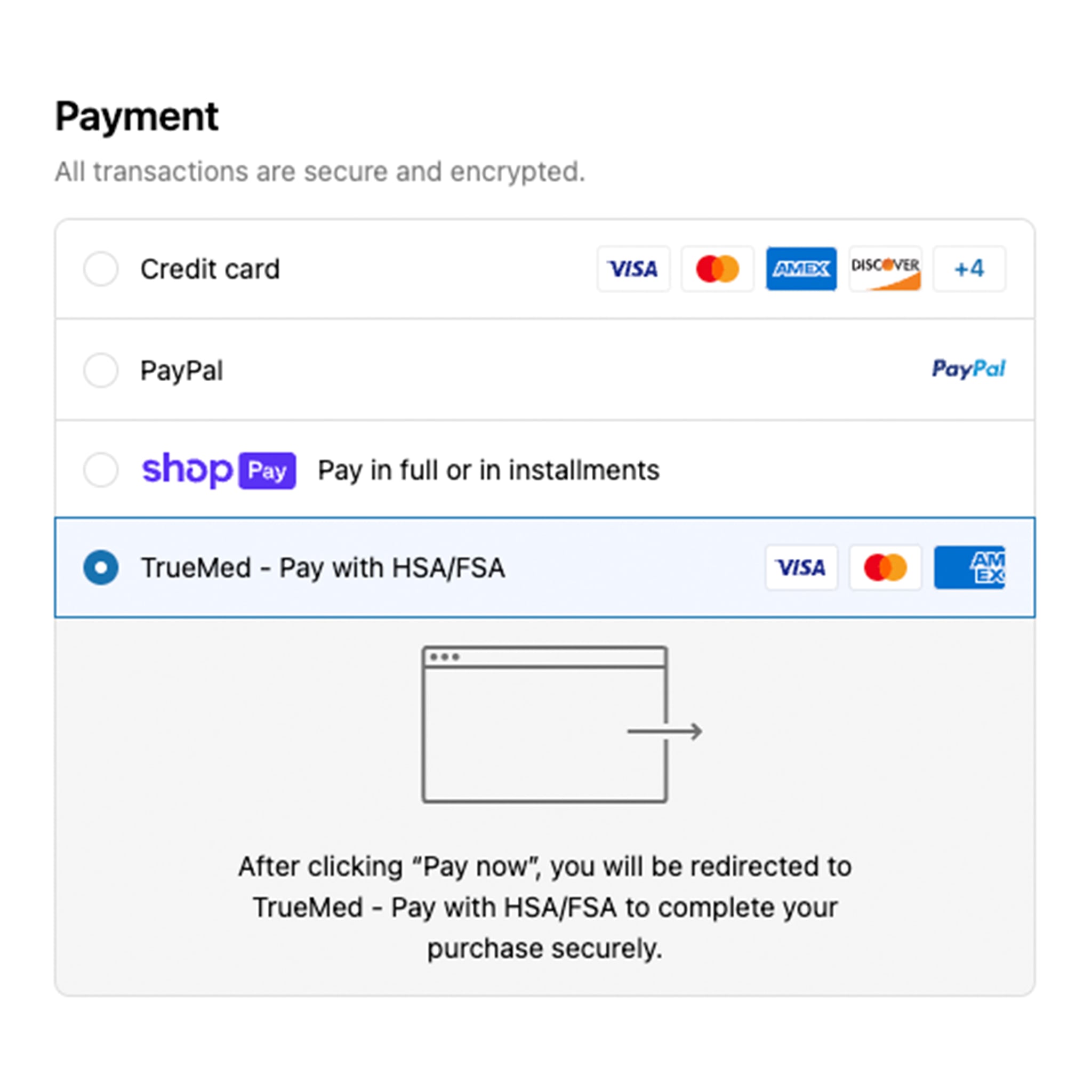

At checkout, select Truemed as your payment option.

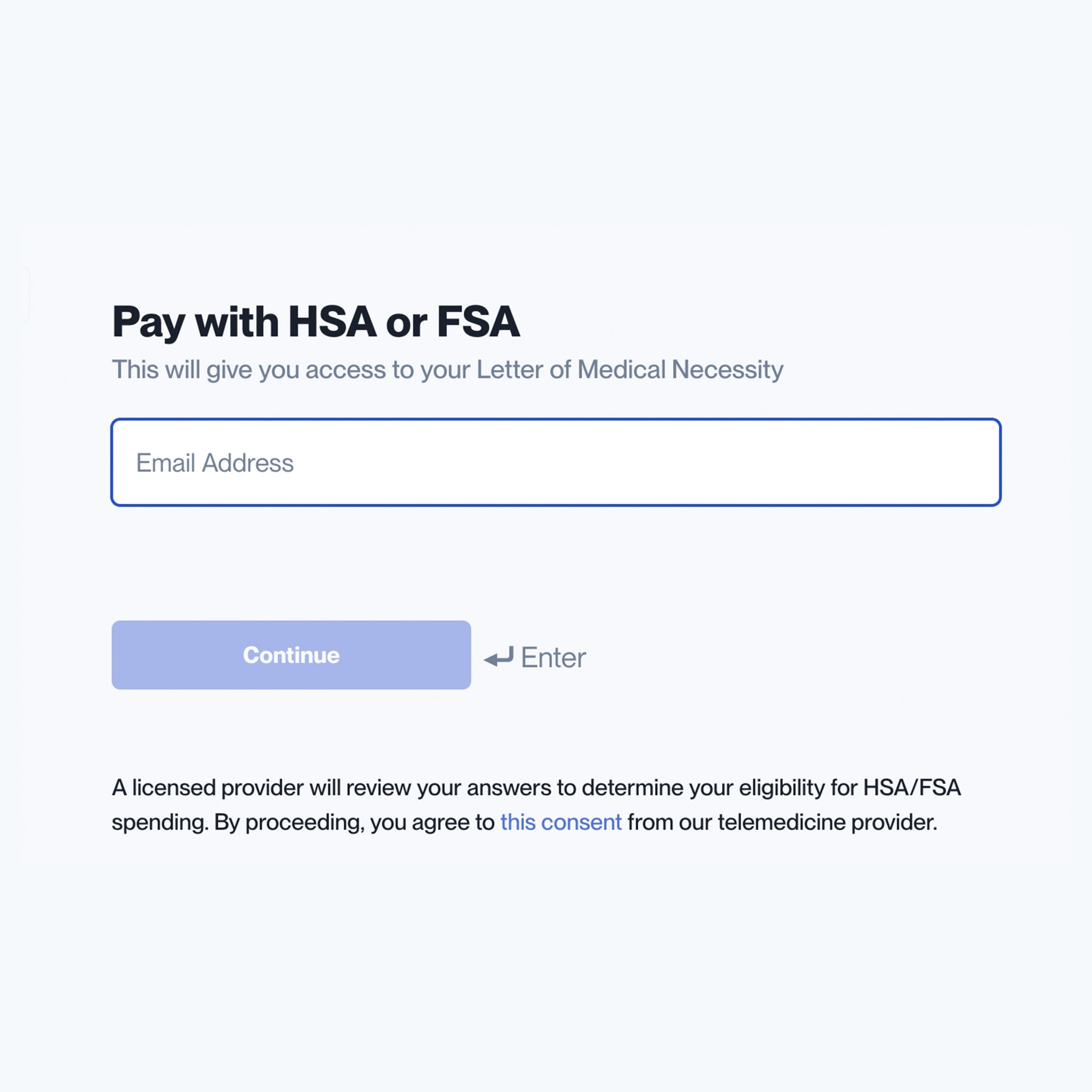

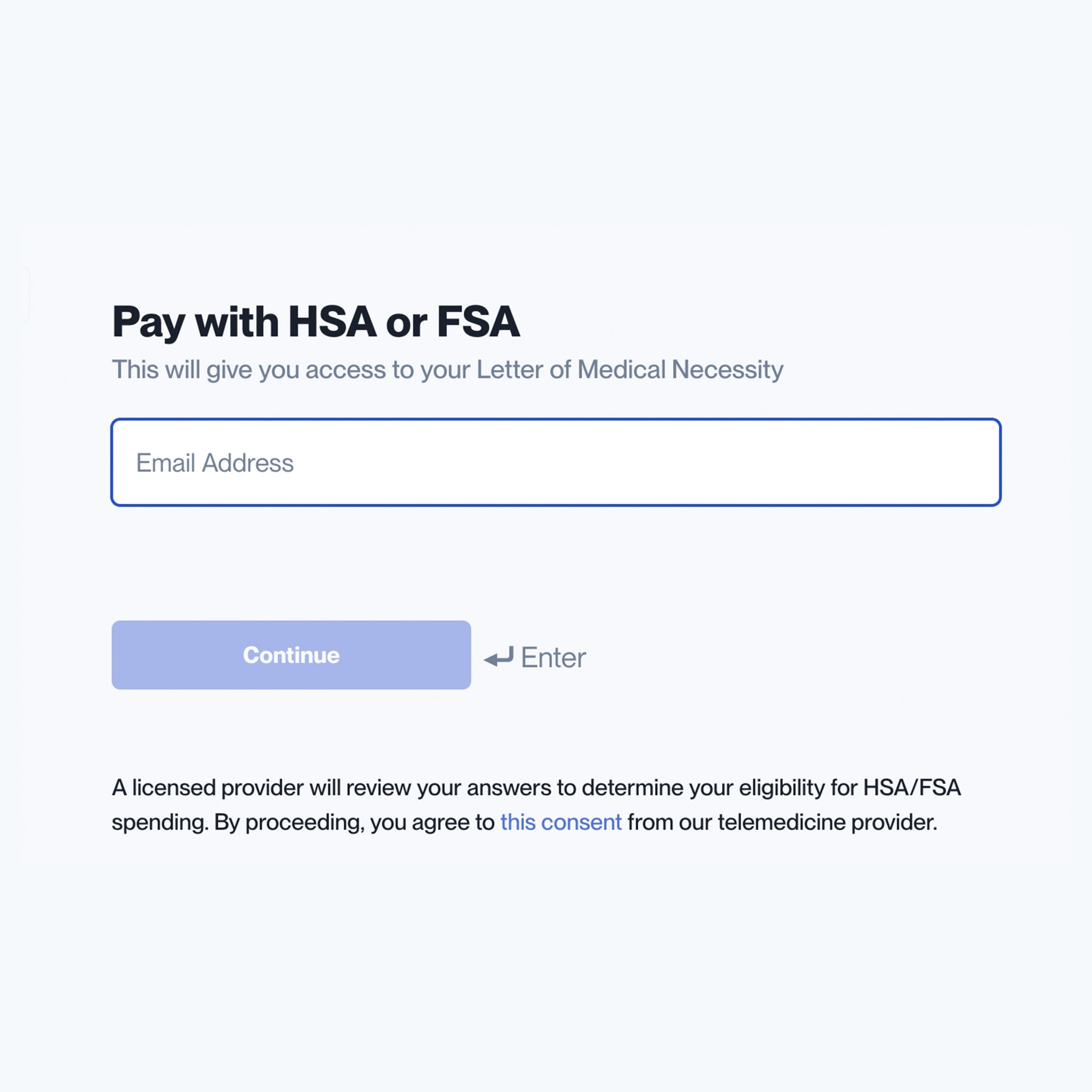

Take 60-second survey to confirm eligibility.

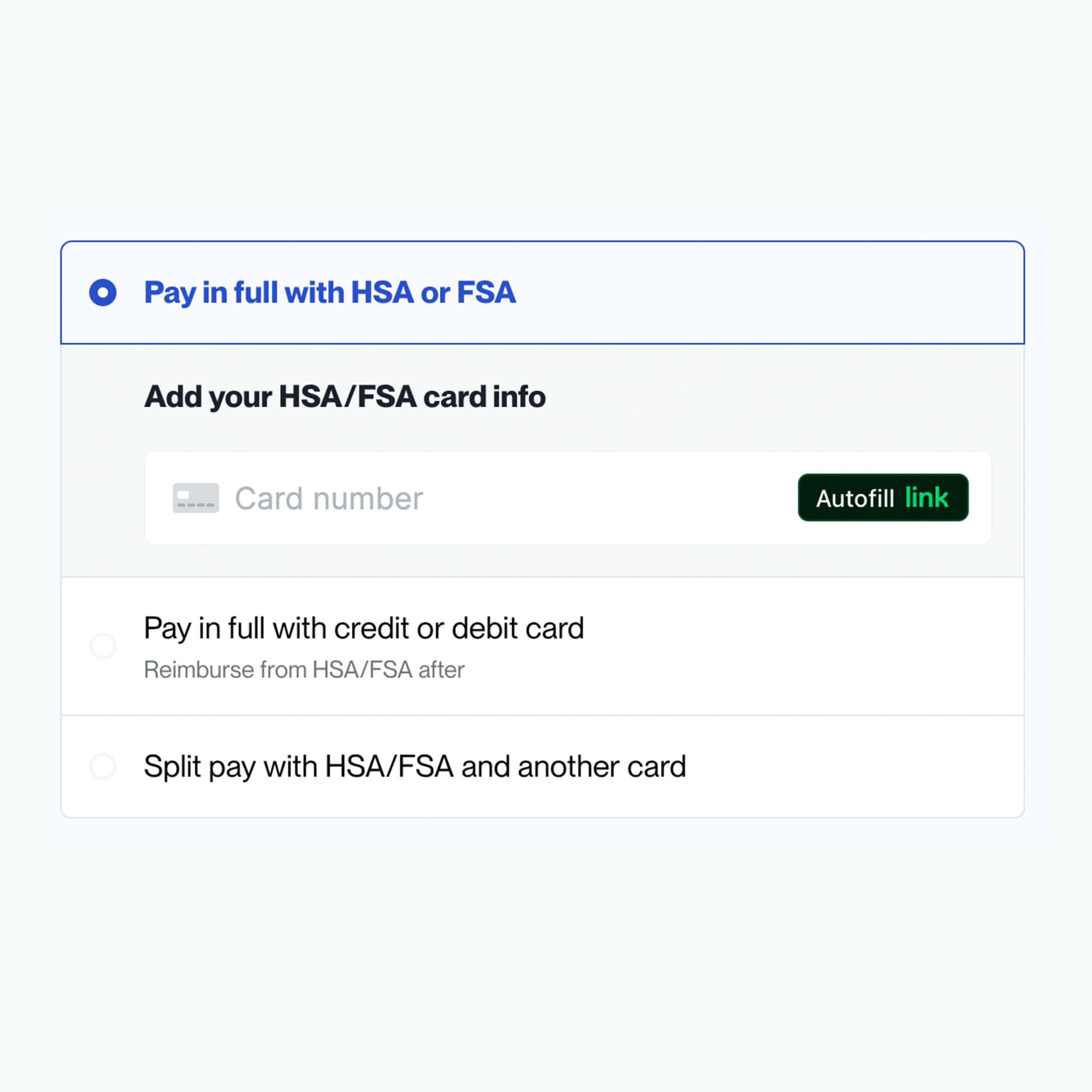

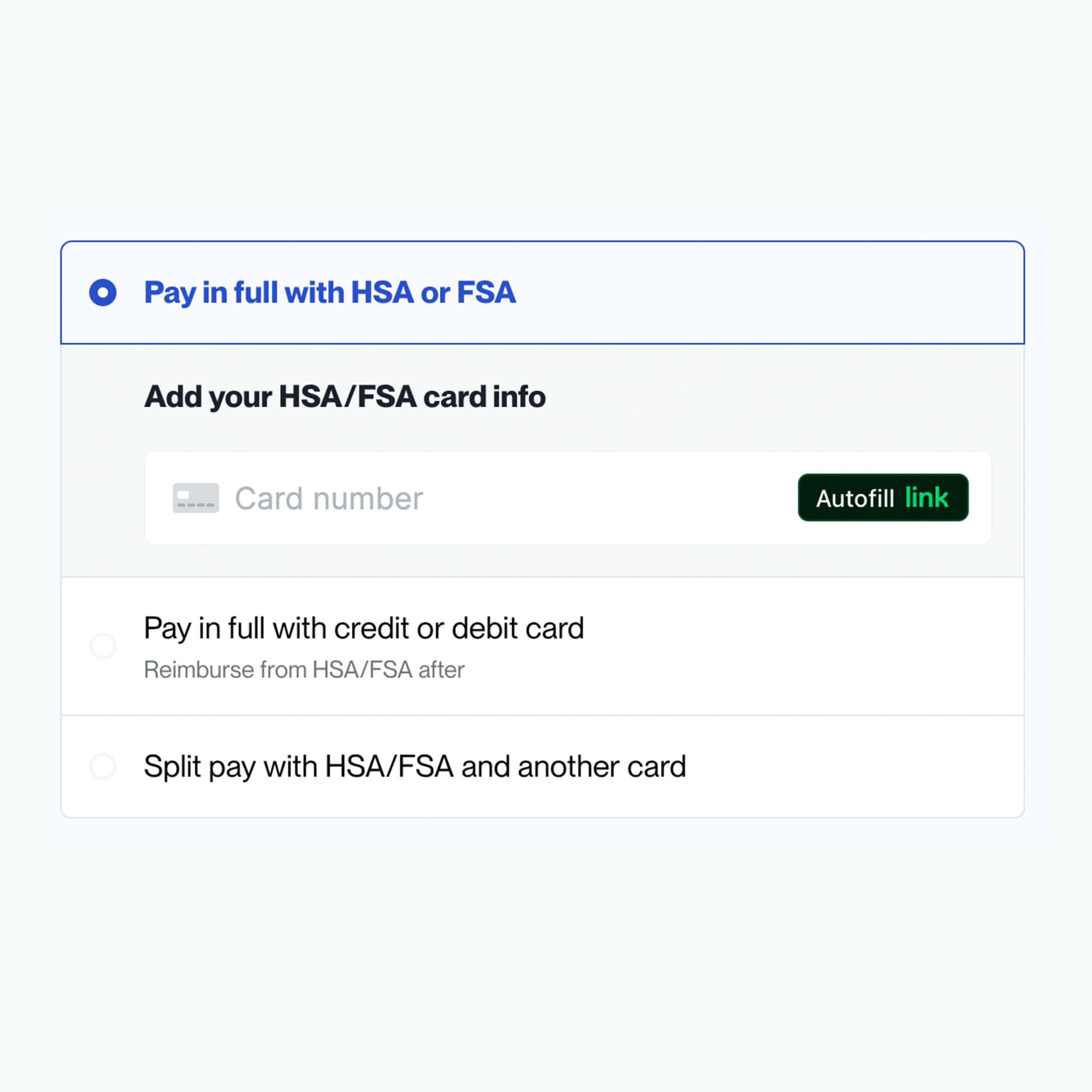

Enter your HSA or FSA card details, or get reimbursed.

Add products to your cart and make sure to click “Try Once"

At checkout, select Truemed as your payment option.

Take 60-second survey to confirm eligibility.

Enter your HSA or FSA card details, or get reimbursed.

Answers to all your questions

What is HSA/FSA

A Health Savings Account (HSA) and a Flexible Spending Account (FSA) are special accounts that let you use pre-tax dollars for eligible health and wellness expenses. This means you can buy certain medical, fitness, or wellness products without paying income tax on that money.

HSAs are tied to high-deductible health plans, and funds roll over year to year. FSAs are offered through employers and often have a “use it or lose it” deadline. You can use either account to pay for res formulas, saving you up to 30% instantly.

How long does it take to get approved?

Most customers receive HSA/FSA approval in minutes after completing the 60-second survey. In some cases, it may take up to 1–2 business days if more details are needed for your Letter of Medical Necessity.

Start your approval today, and you could check out with tax-free dollars by tonight!

Can I submit previous orders for reimbursement?

Yes. If you have a Letter of Medical Necessity that covers the product you purchased, you can often submit past orders for HSA/FSA reimbursement. Check your plan’s rules for how far back you can claim expenses; many allow submissions within the same plan year, and some HSAs allow retroactive claims from previous years.

If you have already purchased from us, apply for your letter now and get your money back! If you need support in doing this, contact us at support@resbiotic.com